delayed draw term loan commitment fee

A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds. Means a with respect to each Delayed Draw Term Loan Lender for the period from and including the Closing Date to but.

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

A commitment fee is a banking term used to describe a fee charged by a lender to a borrower to compensate the lender for its commitment to lend.

. Define Delayed Draw Term Loan Commitment Fee Rate. TAxATION OF DELAYED DrAW TErM LOANS loan market might feature a term loan of 400 million that matures seven years from the closing date a revolving facility of. A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount.

Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender. The Borrower shall pay to the Administrative Agent for the account of each Delayed Draw Term Lender in accordance with its Pro Rata Share a. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the.

Unlike a traditional term loan that is provided in a. What is a ticking fee on a delayed draw term loan. DDTLs provide enhanced flexibility for longer-term capital.

Like revolvers they have commitment fees around 1 and in addition they carry. A ticking fee accumulates on the portion of the undrawn loan until you either use the loan entirely terminate. How are delayed draw term loans structured.

That is the fees. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lenderThe fee amount accumulates on the portion of. If you take out a DDTL youll be responsible for a ticking fee.

Delayed Draw Term Commitment Fee. While the fee structure for DDTLs has always been a negotiated point and has varied based on the actual arrangements sponsorsborrowers and debt providers the migration of the DDTL. When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term.

A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds available to. The Cost of Bespoke Finance. The fee amount accumulates on the portion of the undrawn loan until the loan is either fully used.

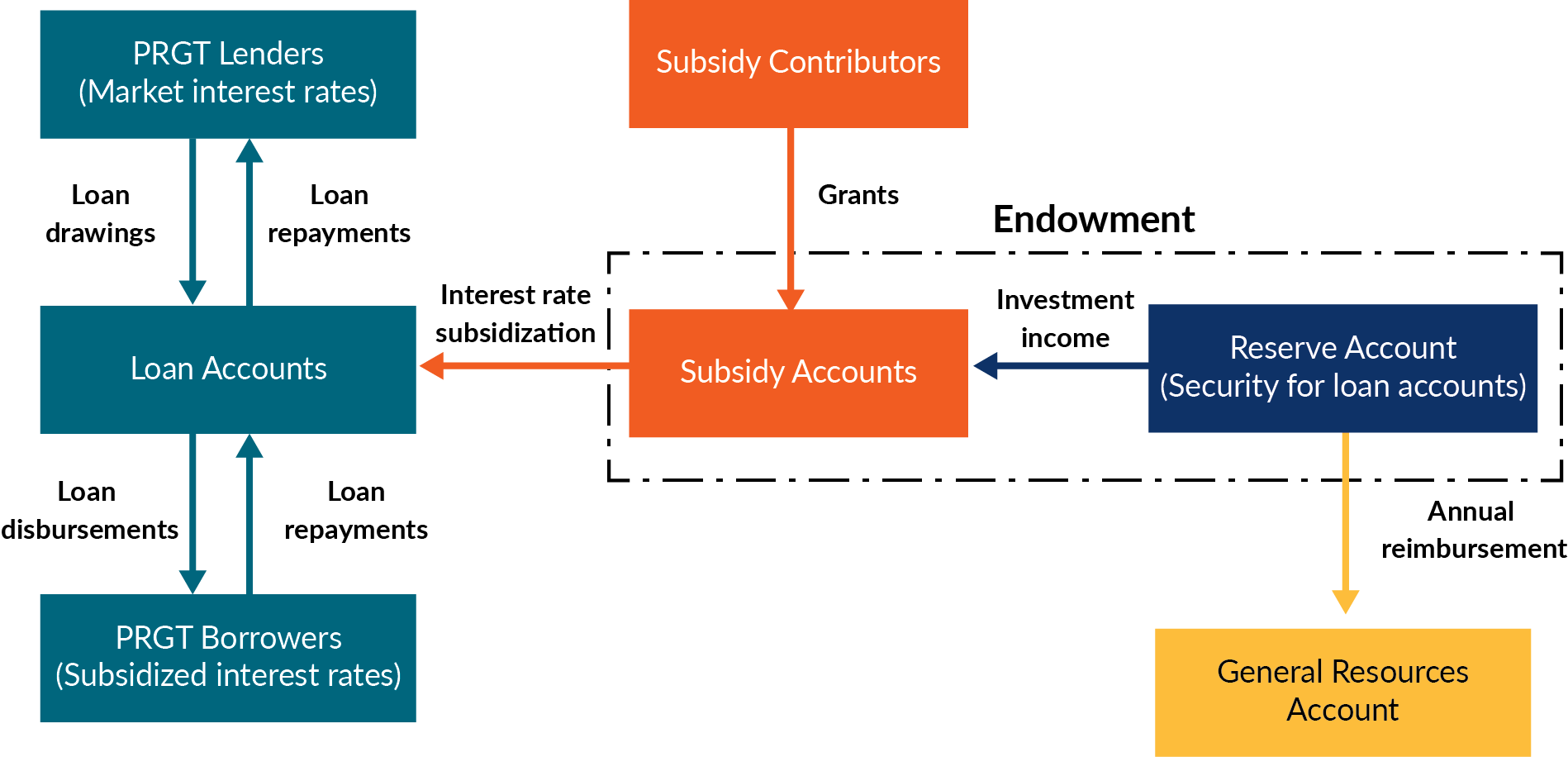

Financing A Possible Expansion Of The Imf S Support For Lics Center For Global Development Ideas To Action

Smiledirectclub Inc 2022 Q2 Results Earnings Call Presentation Nasdaq Sdc Seeking Alpha

:max_bytes(150000):strip_icc()/shutterstock_197115044_mortgage_lender-5bfc317546e0fb00265d0275.jpg)

Delayed Draw Term Loan Definition

Leveraged Loan Primer Pitchbook

Corporate Banking Sell Side Handbook

The Book Of Jargon Us Corporate And Bank Finance

The Book Of Jargon European Capital Markets And Bank Finance

Federal Register Onerd Guaranteed Loan Regulation

Leveraged Loan Primer Pitchbook

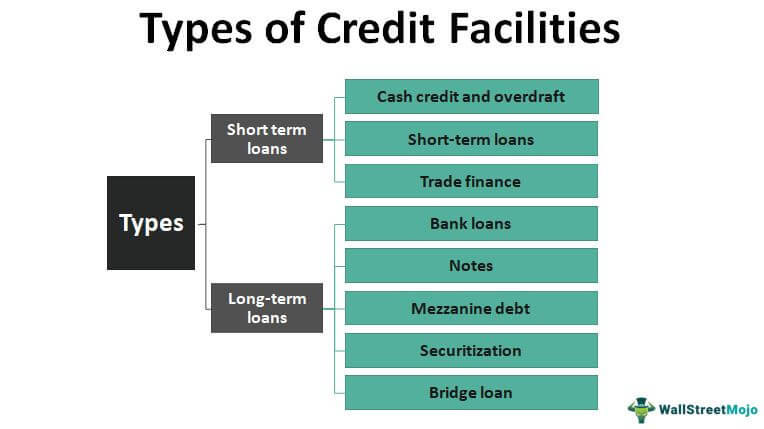

Types Of Credit Facilities Short Term And Long Term

Sec Filing United Airlines Holdings Inc

The Book Of Jargon European Capital Markets And Bank Finance

Kilroy Realty Announces 400 Million Unsecured Term Loan Facility Business Wire

Delayed Draw Term Loans Financial Edge

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management